USDA Loans

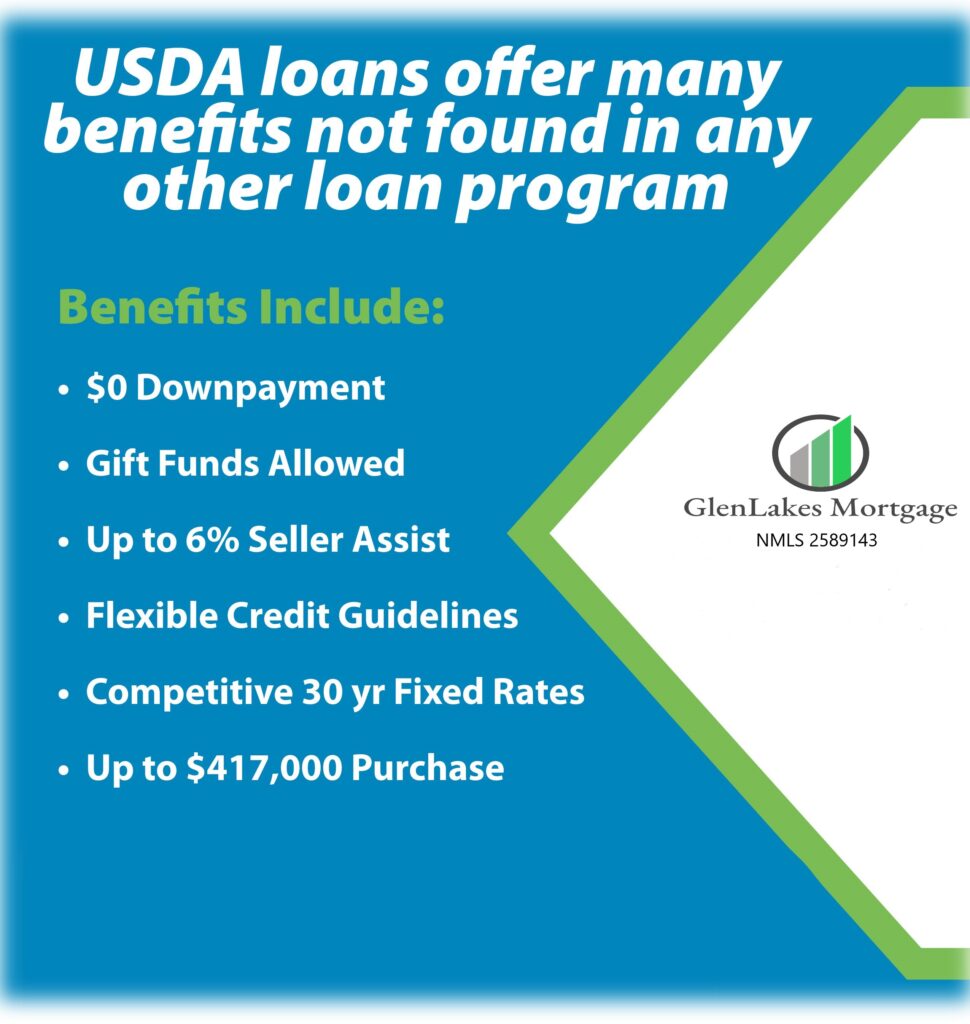

USDA loans are 100% financing options for purchasing a primary residence in qualifying areas. This type of financing is backed by the Rural Development Wing of the United States Department of Agriculture. USDA home loans are only available in specific locations and have are income limitations based on the household size that the applicants must be below.

USDA Loans

USDA Rural Development has partnered with local lenders to help them extend 100% financing opportunities to rural individuals and families. The property itself must meet USDA location and condition requirements. There are many positive aspects to applying for USDA loans if you are not eligible for a Conventional Loan, but there are income limitations and restrictions that vary by different counties and the number of family members that will live in the household. USDA Home loans can be used for the purchase of a primary residence. USDA charges an annual service fee of .35% of the total loan amount, which is paid monthly. USDA also charges an upfront funding fee of 1% of the loan amount. This is a one-time fee and can be rolled into the loan.

Advantages of USDA Home Loans

Clients with little or no money for down payment.

Borrowers who are looking to purchase homes in smaller towns and out of city limits.

First-time homebuyers are looking for more affordable monthly payments.

Borrowers with lower or no credit scores who can’t qualify for conventional loans.

USDA Home Loans

Additional Details

If the property you are purchasing appraises well above the negotiated sales price, a USDA home loans is the only program that allows the option of financing other applicable closing costs and pre-paid, above the loan amount and guarantee fee.

Plenty of USDA territories in Florida.

Accepts lower credit scores compare many other lenders.

Offers very aggressive mortgage rates.

Offers lower fees for USDA loan.

Apply for USDA Loans

At GlenLakes Mortgage we have all the resources needed to make your dream a reality. Are you ready to move forward with your next home purchase? One of our experienced mortgage professionals will guide you every step of the way. Apply now and find out if you qualify for a Rural Development (RD) Home loan.

FAQs about USDA Home Loans

USDA home loan income limits vary based on the county the home is located in and how many people will occupy the home. These limits are set to ensure this program helps those with limited income resources.

Any borrower can qualify for a USDA loan as long as they meet all the requirements as some of those include minimum credit requirements, household income limits, and the property is located in a USDA eligibility area.

USDA rural development (RD) is a 100% home loan, so there is no down payment required. This can significantly reduce the upfront fees associated with buying a home.

Other Loan Types

Contact Us

Customer Service

- (352) 200-2546

- info@glenlakesmortgage.com